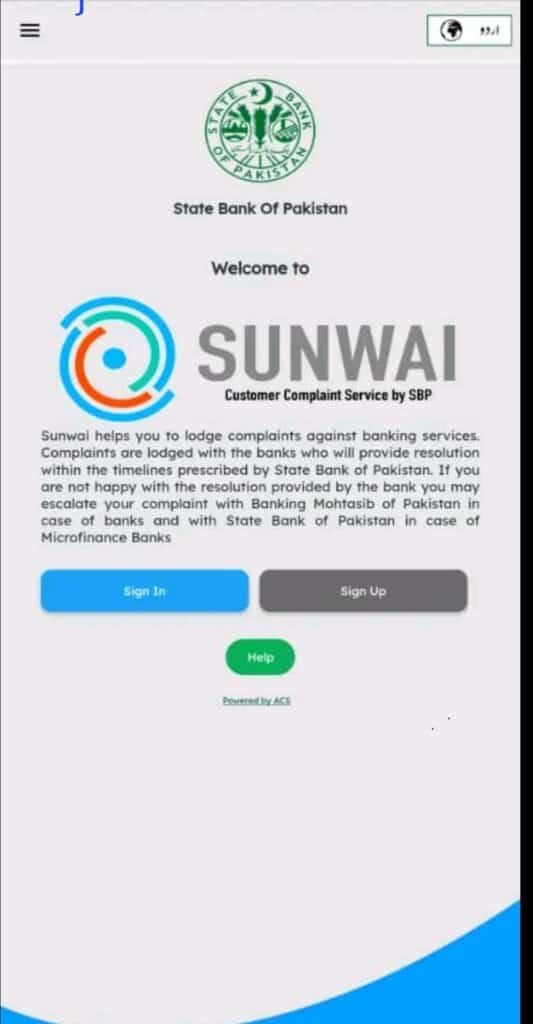

State Bank of Pakistan Launches ‘Sunwai’ -Customer Complaint Service Portal and App

In a significant development for the banking sector in Pakistan, the State Bank of Pakistan (SBP) has rolled out ‘Sunwai,’ a state-of-the-art customer complaint service portal and app. This initiative marks a major step towards enhancing customer experience and trust in the banking system.

The primary aim of ‘Sunwai’ is to simplify and streamline the process of lodging complaints for customers of Banks, Microfinance Banks (MFBs), and Development Financial Institutions (DFIs) operating within Pakistan. The service promises to be a game-changer in how banking grievances are handled in the country.

Functioning as a one-window operation, ‘Sunwai’ offers banking customers a user-friendly platform to register complaints regarding any banking product or service. This includes issues related to Roshan Digital Accounts (RDA). Customers can access the portal through web browsers or mobile applications, with availability on both Android and iOS platforms, ensuring widespread accessibility.

In a statement, an SBP spokesperson highlighted the convenience and inclusivity of the service. Registered users have the option to lodge their complaints in either English or Urdu, catering to a diverse customer base. Each complaint registered through ‘Sunwai’ will be given a unique tracking number. This number will be communicated to the users via SMS and email, allowing them to track the status of their complaints efficiently.

To further assure effective grievance redressal, the SBP has mandated all banks to ensure the prompt and fair resolution of complaints. This directive includes adherence to the turnaround times (TATs) prescribed by the SBP, ensuring timely responses and resolutions for customers.

The introduction of this customer complaint service portal and app is seen as a pivotal move by the central bank. It is expected to significantly contribute to strengthening consumer trust and confidence in Pakistan’s banking industry. The SBP remains optimistic about the positive impact this service will have in promoting transparency and accountability in banking services across the country.